Malaysia Residents Income Tax Tables in 2019. Corporate tax rates for companies resident in Malaysia is 24.

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in Iskandar.

. Companies incorporated in Malaysia with paid-up capital of MYR 25 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on. However with effect from the year of assessment 2020 only companies with a. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

This covers the tax relief import duty personal income tax life insurance EPF SSPN property rebates and more. On the First 70000 Next 30000. Rate TaxRM 0 - 5000.

If the first chargeable income of an SME is RM500000 such a company is charged at a rate of 18. 10 percent for Sales Tax and 6 percent for Service Tax. 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

This page provides - Malaysia Corporate Tax Rate - actual values historical. The CbC Rules require that Malaysian multinational corporation MNC groups with total consolidated group revenues of MYR 3 billion to prepare and submit CbC reports to the tax authorities no later than 12 months after the close of each financial year. Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020.

6 rows Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. Company with paid up capital not more than RM25 million.

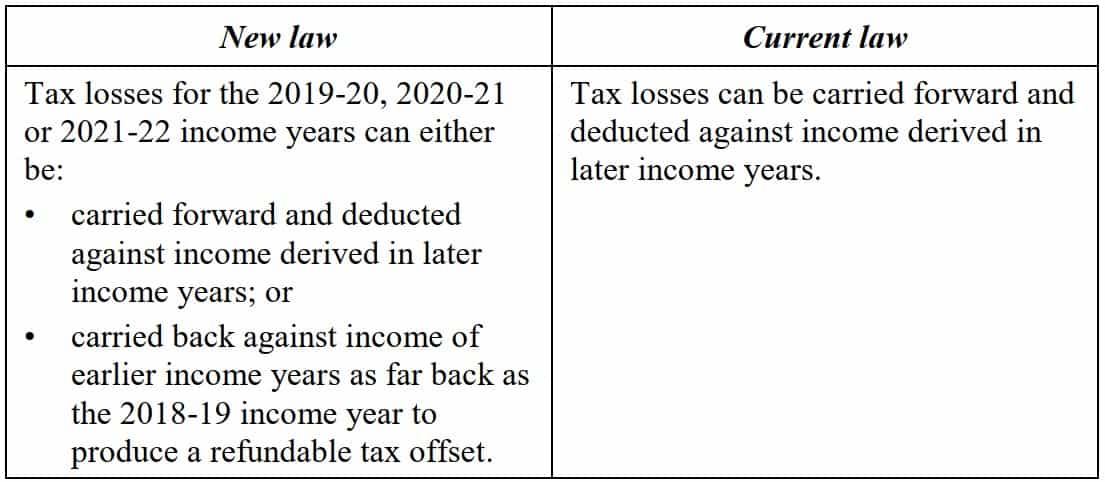

Malaysian entities of foreign MNC groups will generally. Malaysian Tax Issues for Expats - activpayroll OECD Tax Database - OECD Taiwan Corporate Tax Rate 2021. The carryback of losses is not permitted.

On the First 50000 Next 20000. On the First 35000 Next 15000. What supplies are liable to the standard rate.

Insights Malaysia Budget 2019. Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019. Increase to 10 from 5 for companies.

Income tax rates. Company Taxpayer Responsibilities. 1 Corporate Income Tax 11 General Information Corporate Income Tax.

This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. Country-by-country CbC reporting. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Inland Revenue Board of Malaysia. Income from RM500001. On the First 2500.

Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019. For Sales Tax goods other than petroleum products which are not exempted from Sales Tax or not prescribed to be subject to Sales Tax at the reduced rate of 5 percent. Malaysia Residents Income Tax Tables in 2019.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. On the First 5000 Next 15000. In case the income exceeds beyond this limit of chargeable income it is charged at a rate of 24 tax.

Income from RM3500001. Tax Policy Center Corporation tax Europe 2021 Statista. Budget 2019 introduced new tax rates.

Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. Income from RM2000001. On the First 20000 Next 15000.

Data published Yearly by Inland Revenue Board. Income from RM5000001. Similarly non-resident companies are also taxed at a rate of 24.

Tax Rate of Company. Tax Rate of Company. To further support the growth of SMEs and to ensure the lower income tax rate benefits only the eligible SME it is proposed that the chargeable income limit which is subject to 17 tax rate be increased from up to RM500000 to up to RM600000.

Income from RM500001. Income from RM5000001. Income from RM2000001.

Income from RM3500001. Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. SME Chargeable Income Limit Up to RM600000.

Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Income Taxes in Malaysia For Non-Residents.

Thats a difference of RM1055 in taxes. Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021. The maximum rate was 30 and minimum was 24.

Following the Budget 2020 announcement in October 2019 the reduced rate of 17 is applicable to the first RM600000 chargeable income in hopes that more Malaysians will get.

Leitfaden Fur Deine Au Pair Steuern Ayusa Intrax Blog

21 Tax Reliefs Malaysians Can Get Their Money Back For This 2019 World Of Buzz Relief Tax Money

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com Investing Property Investor Investment Property

Why It Matters In Paying Taxes Doing Business World Bank Group

India Crime Rate Against Women Statista

Estimating International Tax Evasion By Individuals

2019 Q4 And Full Year Results Presentation Transcript Novartis

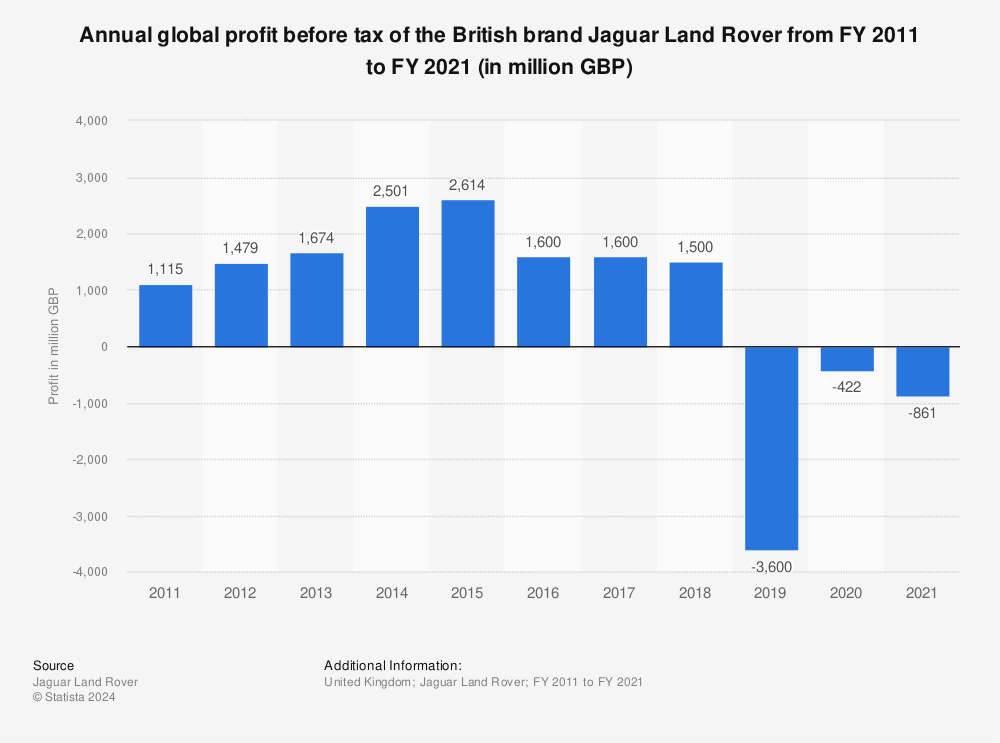

Jaguar Land Rover Profit Before Tax 2011 2021 Statista

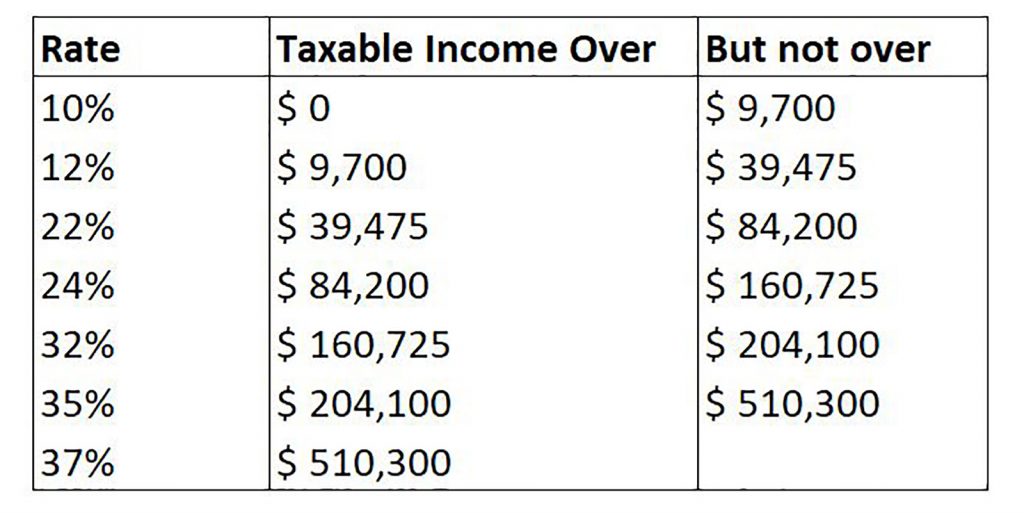

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Company Tax Rates 2022 Atotaxrates Info

Why It Matters In Paying Taxes Doing Business World Bank Group

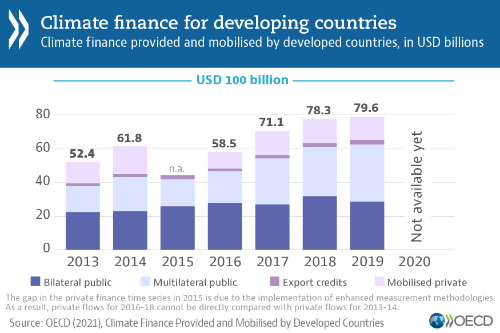

Climate Finance Provided And Mobilised By Developed Countries Aggregate Trends Updated With 2019 Data En Oecd

10 Things To Know For Filing Income Tax In 2019 Mypf My

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting